Financial Directives for the period 2021-2025

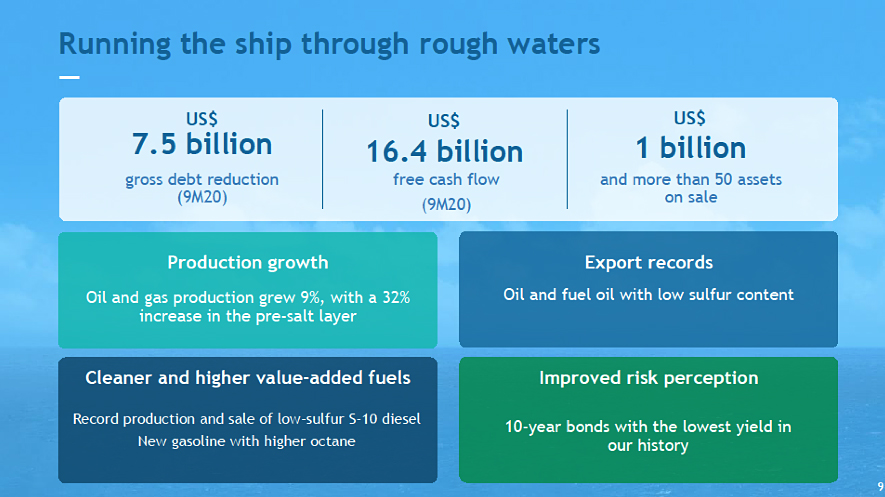

Figure 1 – Financial Directives for the period 2021-2025

(Source : Petrobras’ Strategical Plan 2021-2025)

The main Financial and Operational Directives for the period 2021-2025 are:

- Debt reduction of U$7.5 billion;

- Free Cash Flow of U$16.4 billion;

- Divestments of U$1 billion with the selling of more than 50 assets;

- A better risk perception.

In regard to operations we have:

- Increase of 32% in the Pre Salt production;

- Cleaner fuels with a better aggregated value;

- Record in the exportation of crude oil and fuel oil with low sulfur grade.

Exploration and Production (E&P)

Projects, value maximization and Pre Salt priority

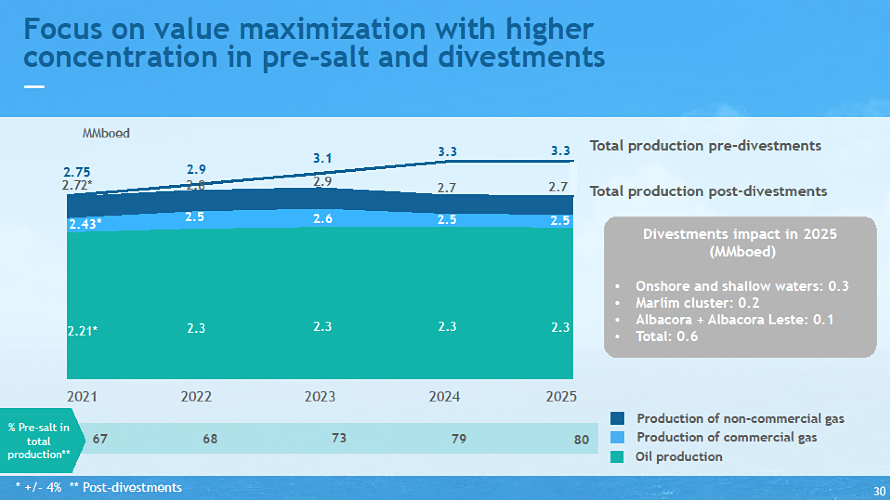

As shown in Figure 2, Brazil’s crude oil output is currently of the order of 2.1 million barrels per day. Up to 2023 the figure will be 2.3 million barrels per day and for the years to come will become stable. The percent participation of Pre Salt wells in this production is 67% and will grow to 80% until 2025.

Figure 2 – Production Curve for the Exploration and Production area of Petrobras as a function of divestments. (Source : Petrobras’ Strategical Plan 2021-2025)

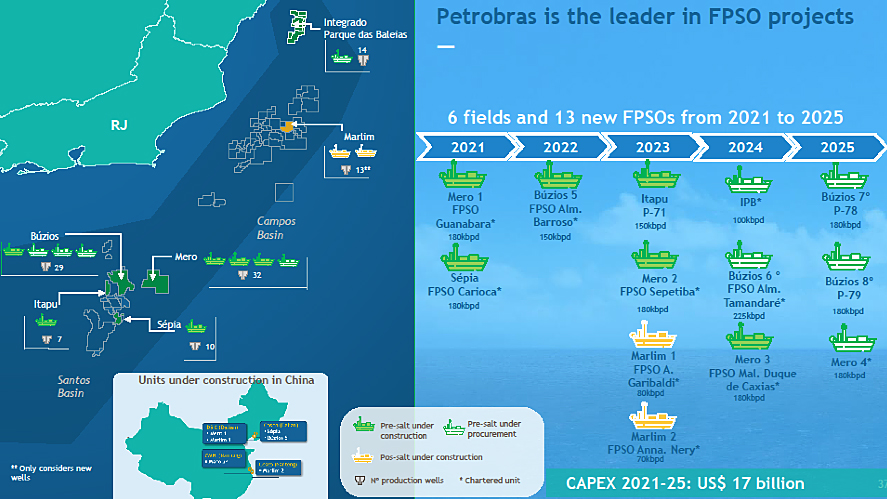

The main E&P projects for the period involve developing the following pre- salt fields: Búzios , Mero , Itapu, Marlim and Sépia as in Figure 3. There will also be significant investment in the Campos Basin, where most of the older Petrobras fields are concentrated. The estimated Capex for the chartering of FPSOs and developing the production (right of the figure) amounts to U$17 billion . It is clear that Petrobras’ option is for chartering the FPSOs.

Figure 3 – Main E&P Projects for the period 2021-2025

(Source : Petrobras’ Strategical Plan 2021-2025)

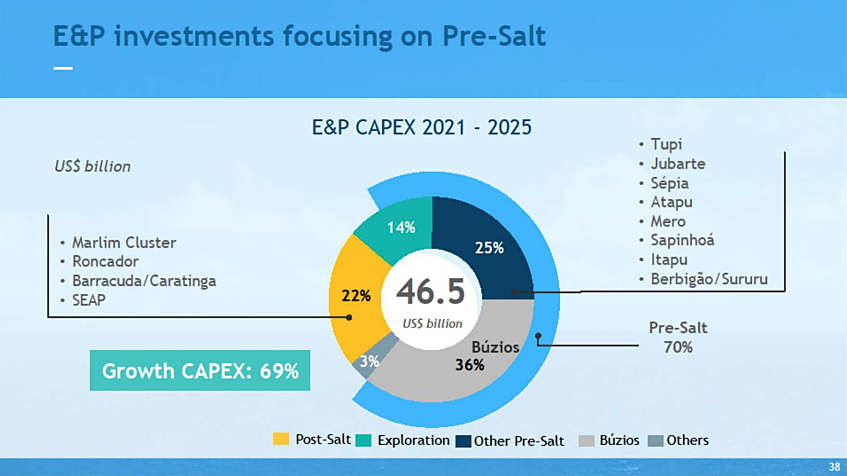

Figure 4 shows the total investments for E&P activities in the period considered. It amounts to U$46.5 billion and 70% of this total is concentrated in the Pre Salt fields and 30% in Post Salt fields.

Figure 4 – Investments in E&P for the period considered

(Source : Petrobras’ Strategical Plan 2021-2025)

Refining

Petrobras is in the process of repositioning its refining activities. Pre-salt exploration and production projects are being conducted in partnerships between Petrobras and other operators, on a model applied by other firms around the world and considered a model of success. In refining, Petrobras position is absolute: it operates its 12 refineries, two hydrogenated fertilizer plants and one naphthenic oil plant on its own. One other refinery, Comperj, is yet to be completed in Rio de Janeiro State.

The present Strategical Plan points to a major change in the refining model in Brazil, opening to other enterprises the possibility of establishing a partnership with Petrobras to operate some of the refineries or even the possibility of acquiring some refineries from Petrobras . The scope of the divestments in the refining activities may extend beyond the refineries themselves to include the related pipelines. The process is now ready for submission to the market and Petrobras shall keep in the assets portfolio only the refineries near the consumption market or near the coastline. Figure 5 shows the evolution of this process.

Figure 5 – Refineries to be divested and refineries to be retained by Petrobras

(Source : Petrobras’ Strategical Plan 2021-2025)

As can be shown in Figure 5, Petrobras will retain REDUC, REPLAN. RPBC, REVAP and RECAP. The other refineries will be divested or in some cases, a partnership shall be considered. The marketshare to be retained by Petrobras in the case of divestments is about 60%.

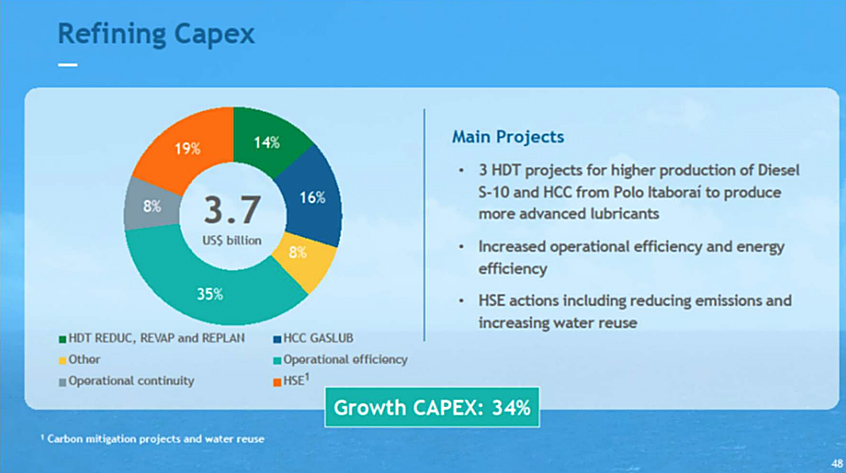

Figure 6 – Capex of the Refining activity for the period 2021-2025

(Source : Petrobras’ Strategical Plan 2021-2025)

For the period considered, Figure 6 shows that the main investments in refining activities are related to:

- Hydrotreating Process Units (HDT) to produce Diesel Oil S-10;

- Increase in the Operational and Energy efficiencies;

- Health Environment and Safety initiatives reducing emissions and increasing the usage of drain water.

Natural Gas

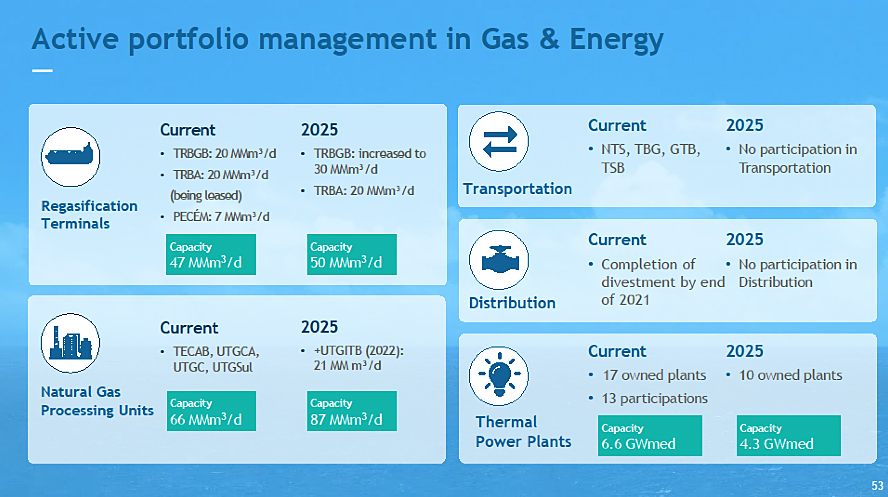

Petrobras’ decision as not to be a protagonist in natural gas transportation and distribution is clear in the Strategical Plan.

As can be seen in Figure 7, Petrobras reduces substantially its participation in the vaporization terminals and in the operation of Natural Gas Treatment Unities keeping only one of the four unities existing today in Brazil.

Figure 7 – Portfolio of the activities for the Petrobras’ Area of Energy and Gas for the period 2021-2025

(Source : Petrobras’ Strategical Plan 2021-2025)

In regard to transportation and distribution Petrobras’ will have no participation at all. The investment resources for these activities will be redirected to the Pre Salt fields. The thermal plants assets will be reduced from the present 17 plants to 10 and the participation that Petrobras’ still have in other 13 plants will be sold.

Figure 8 shows the Capex to be invested for those activities.

Figure 8 – Capex for Petrobras’ Energy and Natural Gas for the period 2021-2025

(Source : Petrobras’ Strategical Plan 2021-2025)

Renewables

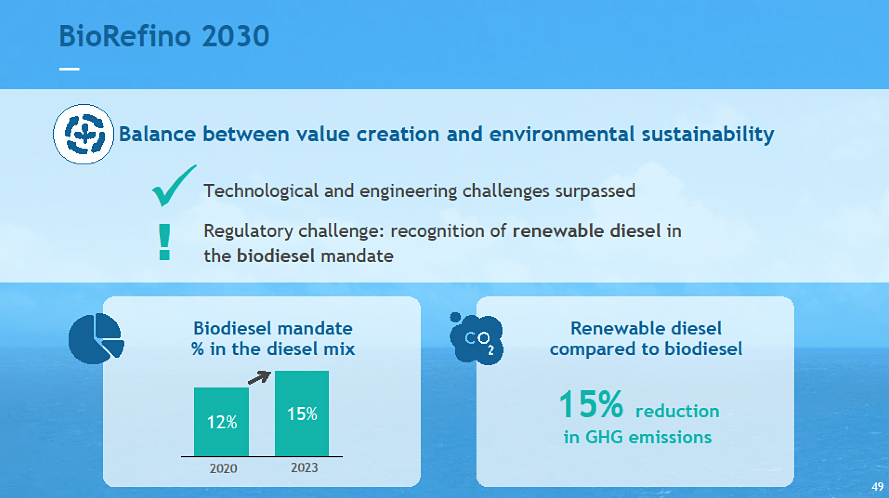

Petrobras activities in Renewable Energies for the period considered are restricted to Bio-Refining and Renewable Diesel Oil with low carbon grade. This can be seen in Figures 9 and 10.

Figure 9 – Bio-Refining priority in Renewable Energies, period 2021-2025

(Source : Petrobras’ Strategical Plan 2021-2025)

In Figure 9 Petrobras states that the technological challenges of Bio Refining has been surpassed and now the challenge is regulation.

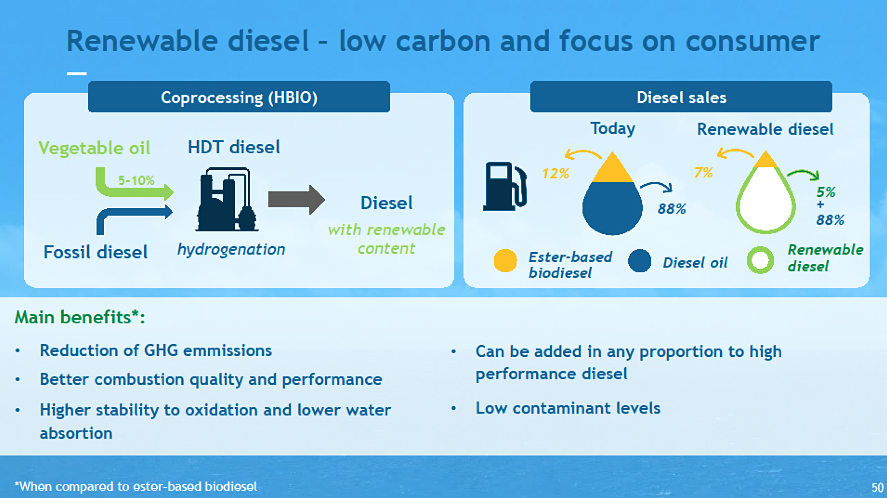

Figure 10 – Benefits of the low grade renewable Diesel Oil

(Source : Petrobras’ Strategical Plan 2021-2025)

Figure 10 shows the benefits of Low Carbon Renewable Diesel Oil.