Oil and Natural Gas

The oil and natural gas industry in Brazil is one of the most dynamic production segments of the economy. Today the Brazilian oil and gas industry comprises a vast array of local and foreign firms working in all links of the business production chain (exploration and production, refining and transport, distribution and marketing of petroleum products). At year-end 2020 it accounted for 13% of Brazil’s US$ 1.4 trillion GDP, corresponding to a contribution of US$ 181.5 billion to the nation’s wealth. The industry brings together enormous volumes of intellectual capital (in firms’ stocks of routines, procedures, standards and systems) and a major contingent of highly qualified postgraduate staffs.

The oil and gas industry in Brazil always poses major technological and financial challenges, because Brazil has practically no oil on land. The great majority of its oil production fields lie on the continental shelf in deep and ultra-deep waters (more than 3,000 metres below the surface). Today, considering exploration and production activities on land and at sea, there are 34 operator companies in Brazil (ANP – Jan/2020 – Relatório da Produção Nacional de Petróleo e Gás) and Petrobras (Petróleo Brasileiro S.A.) continues to maintain its leading position as the largest oil corporation in the country and one of the largest in the world.

In 2020 on the last quarter of the year, Petrobras recorded a mean output of 2.68 million boe/day (Petrobras – Results 2020) considering oil, natural gas liquids and natural gas. The Company posted net profit of US$ 7.1 billion and consolidated EBITDA of US$ 27.5 billion, with 10.6% growth over 2019 (Petrobras Results – 2020) as a result of wider margins on domestic sales and exports, in line with the recovery of Brent prices and lower operating expenditures.

The Brazilian oil regulatory agency (Agência Nacional do Petróleo, ANP) has held auctions of exploration blocks every year. By the ANP’s own reckoning, more than US$ 300 billion will have been invested in the oil, natural gas and renewable energy production chain in Brazil by 2030.

In its Energy Scenarios for 2040 and Strategic Plan 2021-2025, Petrobras took account of major guidelines namely: the COP 21 agreements, now ratified by 179 countries and established the goal of reducing the total operational emissions by 25% up to 2030; the expectation that electric vehicles for shared use will represent 30% of total sales in the automobile market by 2030; the energy inclusion process, which should benefit one billion people in the period with; the smart grid; and the geopolitical consideration that 42% of crude oil production in the world will be concentrated in areas of conflict.

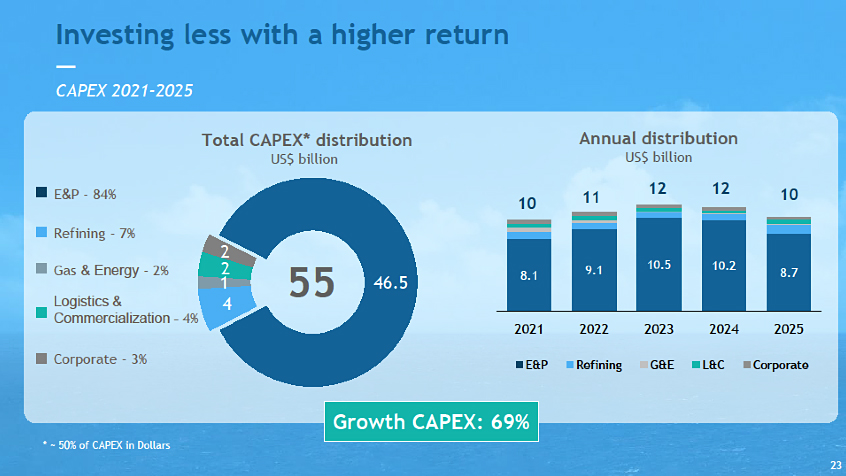

In the period from 2021 to 2023 , Petrobras expects to invest US$ 55 billion, of which US$ 46.5 billion will be in exploration and production, US$ 4 billion in refining, US$ 2.0 Billion in commercialization and logistics, US$ 1.0 billion in gas and energy, and US$ 2.0 Billion in Corporate areas (refer to Figure 1). Petrobras investments represent approximately 95% of total investments in oil and gas in Brazil by all 34 operators currently present on the local market.

Figure 1 – Petrobras’ Investments for the period 2021-2025

Source: Petrobras’ Strategic Plan 2021-2025

Natural Gas

Brazil is a very young country in using natural gas as an energy source and industrial input. Although the United States, Canada, Russia and some eastern European countries have realised the value of natural gas since the early twentieth century (imposed by the need for heating fuel to meet the rigorous winter), the history of natural gas in Brazil can be considered to have begun in 1992 when the Ministry of Mines and Energy (MME) reasserted the strategic goal of reconfiguring Brazil’s energy matrix so that natural gas would account for a 12% share in the matrix by 2010 (documents for this citation can be recovered from Ministério das Minas e Energia home page, www,mme.gov.br) . That goal, set earlier by the MME’s former Gas Commission, was later confirmed by the National Energy Policy Council (CNPE), the chief body responsible for setting policy and guidelines for energy matters in Brazil. The goal was partially achieved with a participation of 10.8% in 2010 (Source IBGE Ids 2012). Nowadays the participation of Natural Gas in the Matrix is 12.2% (EPE 2020).

In order for natural gas to be internalised as a fuel or industrial input in Brazil, numerous infrastructure projects are necessary, especially as regards expanding the network of large diameter gas transport pipelines. These works entail sizeable investments and are the reason for the new regulatory model approved by the Senate on 12/10/2020 (PL 4476/2020) and finally approved by the Congress on 03/17/2021. The main points of this new Law are:

- To develop further the natural gas market attracting new investors/players to the business;

- To increase the competitiveness of the sector;

- To optimize the availability of transportation pipelines (open access);

- Production Cost reduction ant reduction of final price to consumers.

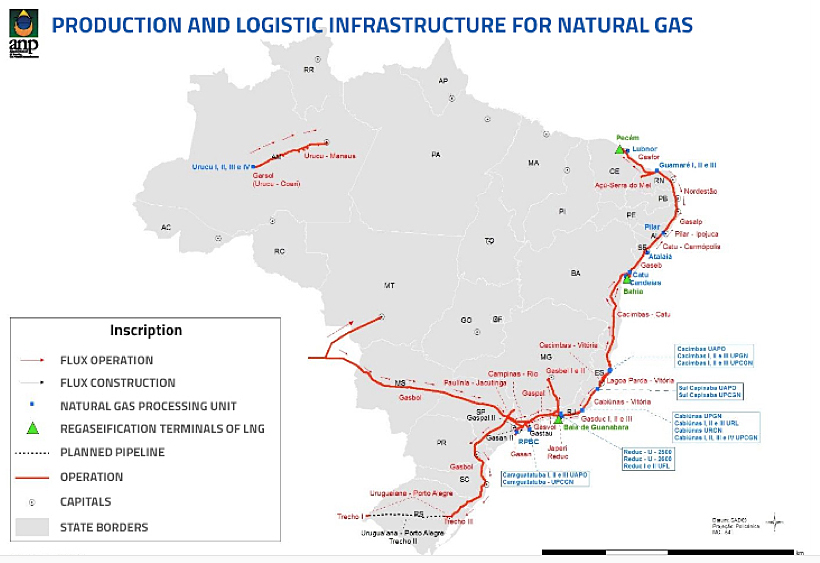

The map in Figure 6 showing Brazil’s gas transport pipeline network gives an idea of what remains to be done. Practically all the pipelines are on the east coast, while inland Brazil is a large empty space. It is exactly that void that offers outstanding opportunities for Brazilian and foreign operators, and goods and service suppliers, wanting to engage in developing this industry, because natural gas is an energy solution that Brazil clearly cannot ignore (see Supplier Chain).

Figure 2 – Natural Gas Transport Pipeline Network in Brazil

Source: National Petroleum Agency – ANP

In December 2020, at Rio Oil and Gas, the largest event of its kind in Latin America, foreign investors agreed that natural gas can play a predominant role in Brazil, but that will require a stable, predictable environment in order to advance with new projects. The passing of Law 4476/2020 may solve the doubts of investors. As an example, from now until 2030, Equinor plans to invest an important amount in the sector, and there was a consensus that the approval of the new regulatory framework the industry will foster open access and competition in the gas sector.

Electricity

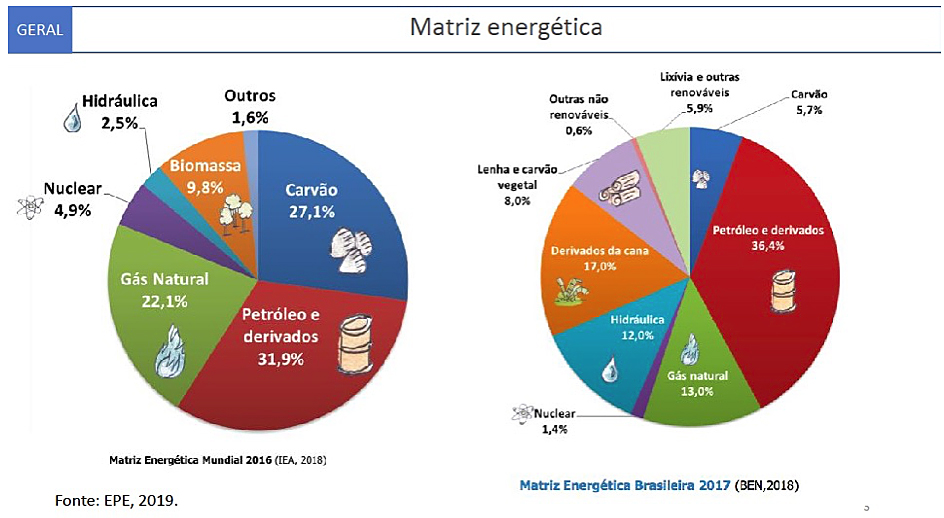

Electricity plays an important role in Brazilian Energy Matrix as can be seen in Figure 3.

“The demand of electricity in Brazil in February 2021 summed to 41.214 GWh, an increase of 1,1% relative to February 2020. On the Other hand, the accumulated demand for 12 months was 475.909 GWh, representing a drop of 1,1%, compared to the previous period.

Among the geographic regions Northeast (+3,1%) and Southeast (+2,1%) showed expansin in the consumption of electricity in February 2021 meanwhile North (-2,8%), Center-West (-1,1%) and South (-0,6%) showed a drop in consumption.

The Industrial Class of Voltage (+4,4%) showed the greatest positive rate of change in the consumption for the month (February 2021) since 2011. This class has been increasing since August 2020. The increase in industry consumption has been driven by the South (+6,0%) and Southeast (+5,2%) regions, what has been happening since December with these two regions alternating in the leadership of the growth indexes.

Figure 3 – Brazilian Energy Matrix in 2017

(Source: EPE 2019)

Since September of last year September, Metallurgy (+208 GWh; +6,6%) and non metallic mineral products (+99 GWh; +9,8%) are the leaders of the expansion but in February 2021, chemical products (+96 GWh; +6,8%). played an important role also.

Residential Voltage Class (+3,4%) showed increase also in electricity consumption during February 2021 driven by Northeast (+6,5%) and Southeast regions (+5,2%).

On the other side,comercial class (-7,3%) still registers drop in the consumption of electricity although less than the average of the last 12 months. Commercial and Services sector continues to be the most affected segment related to the sanitary lockdown imposed by authorities due to COVID 19. All the regions in the country showed a drop in the consumption Regions North (-15,5%) and Center-West (-9,3%) are the regions with the biggest contractions in consumption”.

OBS: (Quotation marks is an excerpt from a technical note issued by Empresa de Pesquisa Energética that can be accessed in portuguese at Notícias Resenha Mensal: O consumo de eletricidade no Brasil em fevereiro de 2021 apresentou avanço de 1,1% em relação ao mesmo mês de 2020 (epe.gov.br)) Epe means Energy Research Company.

”Hidroelectricity has been the main source of generation in the Brazilian electrical system for many decades. both for its economic competitiveness and for the abundance of this energy resource at a national level. Brazil has a generator system with an installed capacity of more than 150 GW, with hydroelectric predominance. This predominance stems from the country’s extensive territorial surface, with many plateaus and large rivers. The Brazilian hydroelectric potential is estimated at 172 GW, of which more than 60% have already been used. Approximately 70% of the untapped potential is located in the Amazon and Tocantins – Araguaia hydrographic basins. It is a mature and reliable technology that, in the context of greater concern with greenhouse gas emissions, has the additional advantage of being a renewable source of generation”.

(Quotation marks is an excerpt from the site of Empresa de Pesquisa Energética (Epe -Energy Research Company) Energia Elétrica Expansão da Geração (epe.gov.br)).

“Thermoelectric generation can be promoted through different fuels: natural gas, biomass, mineral coal, nuclear, fuel oil, among others. The definition of fuel for generation, especially for large plants, is related to meeting technical, economic, logistical, environmental criteria and, in some cases, energy policies”.

(Quotation marks is an excerpt from the site of Empresa de Pesquisa Energética (Epe – Energy Research Company) Energia Elétrica Expansão da Geração (epe.gov.br)).

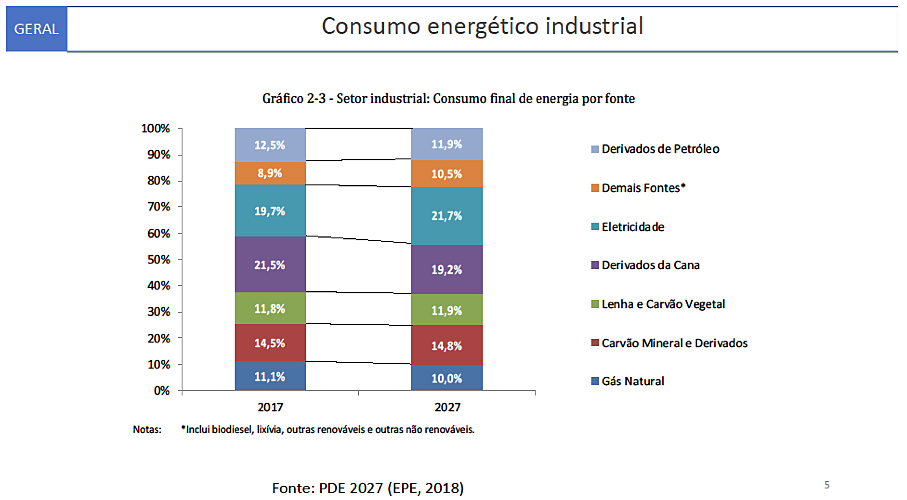

The stratification of the industrial energy consumption in Brazil is shown in Figure 4.

Figure 4 – Stratification of industrial energy consumption in Brazil, several sources

Source: PDE 2027 (EPE 2018)

About 70% of the electricity supply in Brazil is water-based, therefore renewable. The rest is supplied by natural gas thermoelectric plants and wind farms. Very little is thermally based on diesel or other fuels.

Renewables

From 2000 to 2010, Petrobras maintained groups of experts at its R&D centre to study the various forms of alternative energy and the scope for applying them in Brazil. The energy sources studied were wind, solar, ground (geysers), oceans and biofuels. After discovery of the pre-salt oil deposits and in view of the need to develop the fields, where activities were new and expensive, Petrobras gradually shifted its focus away from renewable alternatives until, by 2010, the portfolio was limited to biofuels. Now that the technical and cost challenges of developing the pre-salt deposits have been met, Petrobras has decided gradually to resume its activities in renewables, focusing on Bio Refining and biofuels. That was the most logical decision in view of the drivers of the Strategic Plan and the movements of other operators around the world, who are investing heavily in this area.

However, there is a great deal of activity in investment in renewable energies by other operators and even small companies focused on services in the energy area. The main focus is Solar Energy, since the wind farm is already well developed and Brazil is a country of great average sunshine in all geographic regions, particularly in the Northeast. More details on initiatives aimed at Renewable Energies in Brazil can be obtained on the home pages of the Ministry of Mines and Energy (https://www.mme.gov.br) or the Energy Research Company (www.epe.gov.br).

References

Petrobras’ Strategical Plan

https://www.investidorpetrobras.com.br/resultados-e-comunicados/apresentacoes/

Empresa de Pesquisa Energética – EPE (Energy Research Company)

Energia Elétrica Expansão da Geração (epe.gov.br)

Notícias Relatório Síntese do Balanço Energético Nacional 2019 – Ano base 2018 (epe.gov.br)

Universidade de São Paulo – USP (São Paulo University)

UFRJ, Gesel – Grupo de Estudos do Setor Elétrico (Federal University of Rio de Janeiro – Studies Group for the Electrical Sector) – Panorama Geral do Setor Elétrico e Governança Setorial – Apresentação em Power Point por Victor Gomes – 2019